Your financial well-being, or overall financial situation, is unique to you. Often, we equate how well we’re doing financially with how much money we make, our credit score, or overall net worth1 . In reality, your financial well-being is determined by factors that tell a larger story about your relationship to money. This includes how well you’re able to stay on top of your financial obligations, how secure you feel about your financial future, and ultimately whether you have the freedom to make financial choices that allow you to enjoy your life. “This post “Mo Money: 25 tips to improve your Finances” seeks to provide helpful financial information. The U.S. Census states that 11.8% of Americans live in poverty in 20171 .

The story you tell about your finances doesn’t need to be a scary one. This October, during Financial Planning Month, we’ve pulled together 25 easy-to-follow tips for getting a handle on your money and improving your overall financial well-being. It starts by getting a realistic picture of where your money is coming from and where it’s going. Then, we walk you through how to stay on top of your finances so you can plan—and save—for the future2.

How would you rate your financial well-being? Get started by taking our quiz, and join us online throughout October by following #FinancialPlanningMonth and sharing these tips and tools.

Understand where your money goes

The prequel to your financial story begins with a look into your past and current finances. What do you spend money on, and where are you getting your income? By tracking these factors, you can get a better sense of your financial picture today so you can plan for the future.

1. Take our quiz to see how healthy your finances are.

Answer just 10 questions to measure your financial well-being and get a few steps for making improvements. Take it now, then take it again later to see if your story has changed.

2. Learn where your money is coming from.

Before you can make any improvements, you need to get an accurate picture of your finances. Start by tracking your sources of income.

3. Learn where your money is going.

Fill out our spending tracker to get a sense of your regular expenses. To get a handle on your money, you need a system that will allow you to track your daily spending on an ongoing basis. Find and stick to a system that works best for you.

4. Write your bill due dates on a calendar.

If you have trouble making ends meet at the end of the month, the timing of your income and expenses may be off. It’s often helpful to see the full picture. Write down the due dates for your bills on a printed calendar that you can look at regularly as you plan for the weeks ahead.

Small changes can make a big difference

There are some easy steps you can take to turn the corner on your finances. Once you have an accurate picture of your money, follow these tips to start aligning your expenses to your income.

5. Create a working budget that matches your cash flow.

Your cash flow is the timing of when money comes in and when it goes out. Looking at it on a week-by-week basis, especially if you tend to run short, can help you create a working monthly budget.

6. Request due dates for your bills that help you stay on track.

If there are certain weeks when money is especially tight, you can contact your creditors and utility companies and request new due dates that better align with your income.

7. Compare your spending month-to-month.

Track your spending closely for several months. By looking at your spending in real-time and comparing it to the previous month, you’ll start to see places where you can make adjustments and move money into savings.

Save for emergencies

Saving money might feel out of reach at times, but consistently putting away even small amounts of money can make a big impact over time. Check out our tips for making saving a part of your everyday routine, and then watch it grow.

8. Give yourself financial security with an emergency savings fund.

Start by putting aside what you can afford in order to help cover many common emergencies, such as a car repair or medical bill, that could otherwise become costly debt. Prioritize a dedicated savings account for these unexpected expenses as one of your top savings goals, and as you get a better handle on your overall financial situation, you may decide to set more aside.

9. Set rules for your emergency savings–but don’t be afraid to use it.

Set guidelines for yourself for when you can spend down this savings fund and what constitutes an emergency, but if you need it, don’t be afraid to use it. That’s what it’s there for. Just remember to work to rebuild it.

10. Make saving easy by making it automatic.

Whether it’s through your bank or employer, there are a number of ways to have money automatically transferred into your savings every week or month. Reoccurring transfers are considered one of the most effective ways to build your savings.

11. Put extra money into savings at times when you have it.

There may be weeks when money is tighter than others. Take the opportunity to put money into savings when you have it.

12. Use your tax refund to help you reach financial goals.

For many Americans, a tax refund can be one of the largest checks they receive all year. Make a plan now to dedicate a portion of that money to saving for some of your larger financial or savings goals.

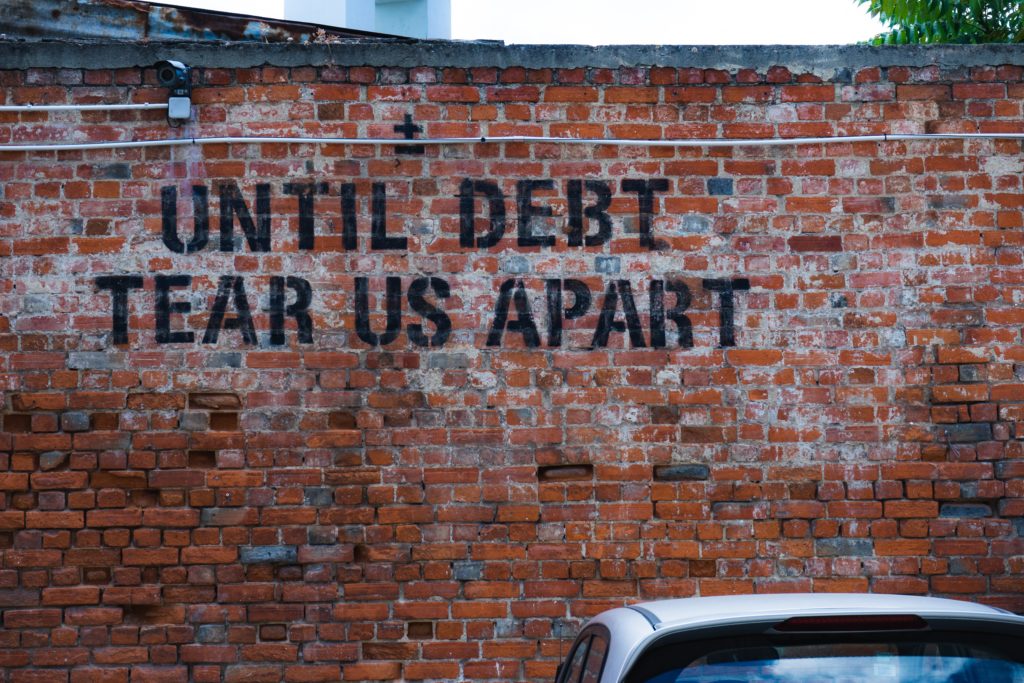

Reduce your debt

Paying down debt can seem scary or tough, but with some proven strategies, you can make it happen, bit by bit. Our tips for reducing debt can help you find the right methods to trim your debt into something that feels manageable.

13. Before making a plan to pay down your debts, know what you owe.

Use our debt log to get a sense of the amount of debt you owe, including interest rate and projected payoff date, and who you owe it to.

14. Choose a debt reduction strategy that works best for you.

There are two common strategies to pay down your debt: the highest interest-rate method and the snowball method. Learn the differences and pick the one that works best for you.

15. Learn about federal and private student loans repayment options.

Whether you have federal or private student loans, or a mix of the two, start with the loans you’re most concerned with, and learn how to optimize paying them off.

16. In the market for a car? Negotiating can save you hundreds or thousands of dollars over the life of your loan.

Plan ahead, and learn what’s negotiable.

Create better money habits

Improving how you manage your money on a daily basis may take time and dedication, but as you develop better money habits, you’ll create a financial story that you’re proud of.

17. Apply only for credit you need.

While it’s not the only factor, a good credit score is key to your financial well-being. One way to get and keep a good credit score is to apply only for credit you need.

18. Set an annual reminder to check your credit reports.

You’re entitled to free credit reports every 12 months, so set up an annual reminder to review them for any errors that may be hurting your credit and should be fixed.

19. Set up alerts to stay on top of your checking account balance.

Through most banks and credit unions, you’re able to set up alerts to notify you of your checking account balance at the end of the week or if your balance gets low. This helps you monitor your accounts and also protects you from incurring additional overdraft fees.

20. If you can’t make a bill payment, act fast and call your creditors.

Missing a bill payment can have several negative financial impacts. If you’re experiencing a financial emergency, contact your lenders or creditors before your due date to see what options may be available to you.

21. When shopping for a loan, get quotes from at least three lenders.

One of the best ways to save money on a loan is to shop around and get estimates from several lenders to best compare terms and fees. This is true for home loans as well as other types of loans, including auto loans.

Plan for success

Planning ahead is always helpful, and once you get a handle on your current financial picture, set some goals for what comes next. By building a plan, you have a roadmap to help guide you through the rest of your story.

22. When planning for the future, set SMART financial goals.

Break down your financial goals so that they’re Specific, Measurable, Achievable, Relevant, and Time-bound. While dreams tend to be aspirational and often vague, setting actionable SMART goals can help you reach your dreams.

23. Set up a 529 savings plan for your children.

If you have young children, college may seem far off, but to help reduce their need for student loans, a 529 plan is an investment account where your money can grow tax-free.

24. Make your savings consistent.

Putting even a small amount into savings on a consistent basis is one of the best ways to get your savings to grow so you can meet your goals, small or large. Set your own personal savings rule to live by and make a plan on how to achieve it.

25. Prepare for life events and large purchases by planning ahead.

Once you get a handle on your finances, you can start to map out life events and large purchases, so you can begin saving!

If you’ve taken some time to work through these tips, starting with our financial well-being quiz, we encourage you to go back and take it again at the end of October. Improving your financial health and well-being takes time, but the more you know, the more empowered you’ll be to make informed decisions that’ll improve your financial future.

Looking for other tools?

Sign up for our Get a Handle on Debt and Start Small Save Up, email series’ that deliver step-by-step resources directly to your inbox and make it easy to create plans to reduce your debt and save for the future.

Jay Harold hopes you enjoyed this post, “This post “Mo Money: 25 tips to improve your Finances” seeks to provide helpful information. Please share this post and read more about Jay Harold here. Please take this advice from Muhammad Ali and give back to others. “Service to others is the rent you pay for your room here on earth.”